Cryptocurrency wallet

“Wow, at once I can only dream about having this type of money. I can now quit my job, buy a lambo, and partially retire from here on out, but you know what? THATS NOT GOOD ENOUGH!! The dangers of homeopathic medicines I DON’T CARE IF I WATCH THIS GO BACK TO ZERO! I’m gonna keep holding for another 4 years until this is worth MILLIONS, and MILLIONS before I even think about taking profits. IT’S ALL OR NOTHING!”

Conclusion: I think that during a bull market (which we are in now) its better to just leave your money in a specific coin instead of switching it around and trying to time the dips. Instead of trying to time the market ups and downs, reload when a coin drops significantly and continue holding. Keep adding to your position on the dips.

To conclude, it is important to note I am not a financial advisor and this is how I approach my investment in crypto! Please remember to DYOR as always, especially on DeFi protocols because they can get really confusing on the terms, fees and the steps involved!

an exchange that deals primarily in shitcoins, or the vast majority of their coins are shitcoins. these are usually exchanges with really low volume but are a vital piece of the crypto trading community as a place to go with a few bucks when you’re bored and want to take a little gamble.

Looking back I see how much money I lost out on from not holding onto my coins, and instead switching between coins. I was heavy in UNi when it was about $3. I sold around $4 but now it’s at $20. Same with Atom, ALGO, and XTZ. Sure I still made a good return, but I could have made an almost 1000% return if I would have just held it in any one of those (minus XTZ).

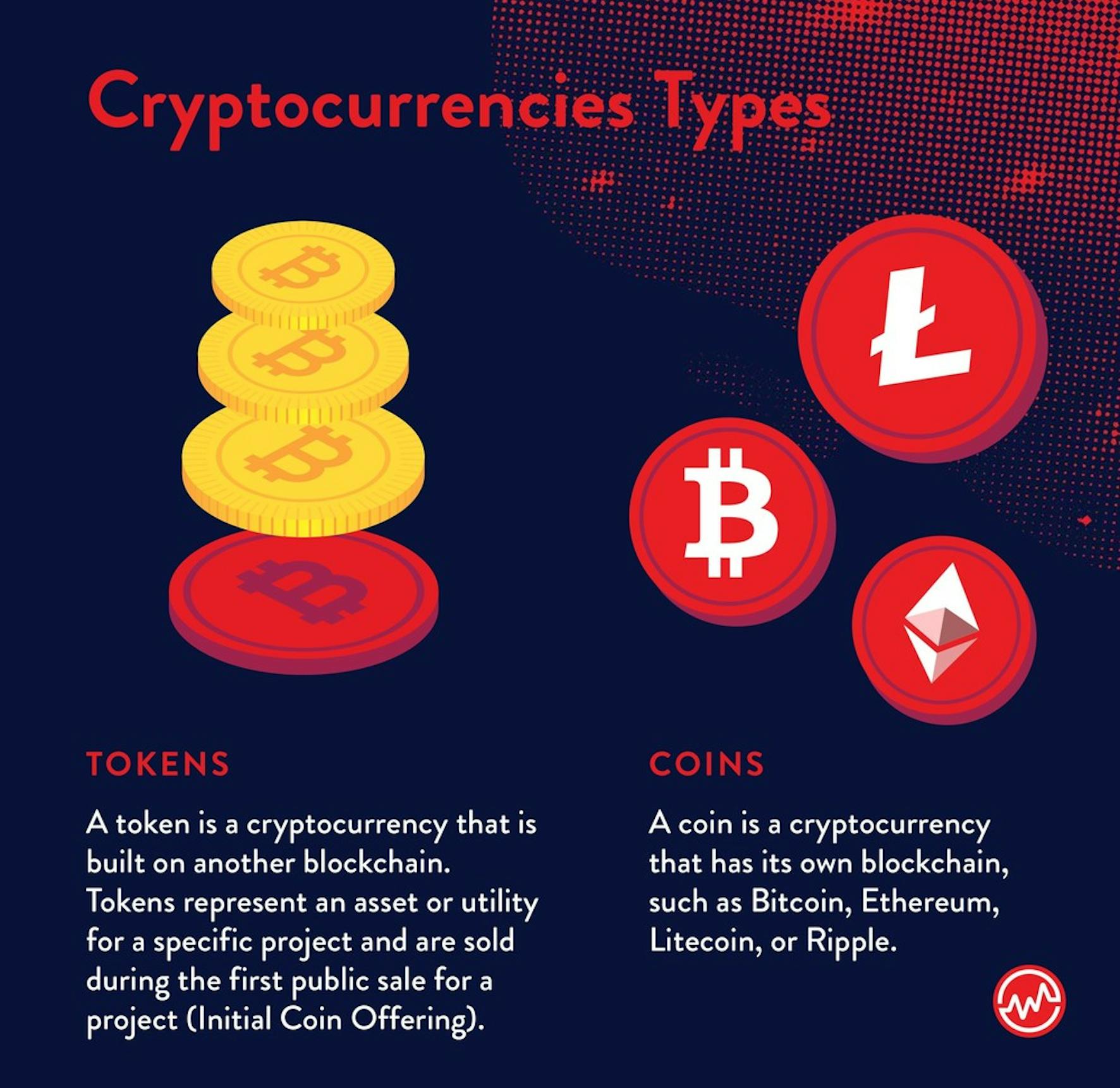

Types of cryptocurrency

This group of GameFi crypto includes all tokens that serve critical roles in metaverse games, including projects such as Axie Infinity (AXS/SLP), Splinterlands (SPS/DEC), Alien Worlds (TLM), Decentraland (MANA/LAND) and The Sandbox (SAND).

Stablecoins: These cryptocurrencies are tied to a stable asset’s value, like the U.S. dollar. Their goal is to keep cryptocurrency valuations steady, as opposed to the wide swings observed in the prices of other common cryptocurrencies. Examples include Tether (USDT) and USD Coin (USDC).

This group of GameFi crypto includes all tokens that serve critical roles in metaverse games, including projects such as Axie Infinity (AXS/SLP), Splinterlands (SPS/DEC), Alien Worlds (TLM), Decentraland (MANA/LAND) and The Sandbox (SAND).

Stablecoins: These cryptocurrencies are tied to a stable asset’s value, like the U.S. dollar. Their goal is to keep cryptocurrency valuations steady, as opposed to the wide swings observed in the prices of other common cryptocurrencies. Examples include Tether (USDT) and USD Coin (USDC).

If you’ve heard of cryptocurrency, chances are you’ve heard of Bitcoin, which introduced the world to digital money. Launched in 2009 by a pseudonymous creator called Satoshi Nakamoto, Bitcoin was designed as a decentralized, peer-to-peer network for sending money around the world outside traditional banking system guardrails. It was the first cryptocurrency to garner widespread acceptance, and remains by far the most valuable cryptocurrency in the market. Considered by many as a form of “digital gold”, Bitcoin is popular as both an investment and a store of value. It’s accepted as a form of payment by many merchants and service providers worldwide.

ERC-20 is the technical standard for fungible tokens created using the Ethereum blockchain. It sets the rules for a token to work on the Ethereum platform. There are other standards for NFTs; ERC-721 and ERC-1155 are common technical token standards.

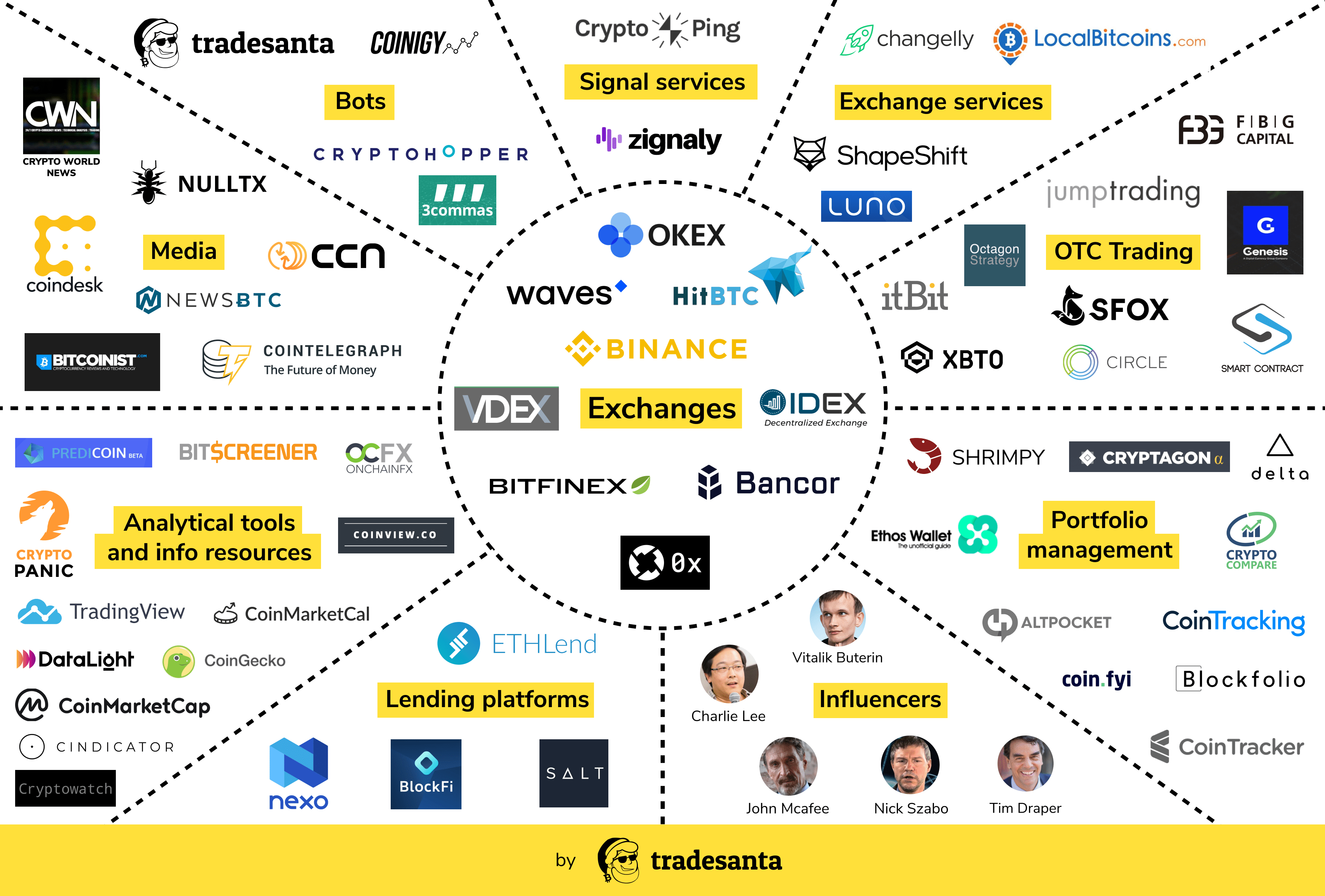

Cryptocurrency market

Chez CoinMarketCap, nous travaillons dur pour que toute l’information pertinente et actualisée sur les cryptomonnaies, les monnaies et les jetons soit rassemblée dans un même lieu facile à découvrir. Dès le tout premier jour, l’objectif était de faire du site la référence en matière de données du marché crypto, et nous travaillons sans relâche pour enrichir le quotidien de nos utilisateurs avec des informations aussi précises qu’impartiales.

Price volatility has long been one of the features of the cryptocurrency market. When asset prices move quickly in either direction and the market itself is relatively thin, it can sometimes be difficult to conduct transactions as might be needed. To overcome this problem, a new type of cryptocurrency tied in value to existing currencies — ranging from the U.S. dollar, other fiats or even other cryptocurrencies — arose. These new cryptocurrency are known as stablecoins, and they can be used for a multitude of purposes due to their stability.

Bitcoin has not been premined, meaning that no coins have been mined and/or distributed between the founders before it became available to the public. However, during the first few years of BTC’s existence, the competition between miners was relatively low, allowing the earliest network participants to accumulate significant amounts of coins via regular mining: Satoshi Nakamoto alone is believed to own over a million Bitcoin.

Chez CoinMarketCap, nous travaillons dur pour que toute l’information pertinente et actualisée sur les cryptomonnaies, les monnaies et les jetons soit rassemblée dans un même lieu facile à découvrir. Dès le tout premier jour, l’objectif était de faire du site la référence en matière de données du marché crypto, et nous travaillons sans relâche pour enrichir le quotidien de nos utilisateurs avec des informations aussi précises qu’impartiales.

Price volatility has long been one of the features of the cryptocurrency market. When asset prices move quickly in either direction and the market itself is relatively thin, it can sometimes be difficult to conduct transactions as might be needed. To overcome this problem, a new type of cryptocurrency tied in value to existing currencies — ranging from the U.S. dollar, other fiats or even other cryptocurrencies — arose. These new cryptocurrency are known as stablecoins, and they can be used for a multitude of purposes due to their stability.

Bitcoin has not been premined, meaning that no coins have been mined and/or distributed between the founders before it became available to the public. However, during the first few years of BTC’s existence, the competition between miners was relatively low, allowing the earliest network participants to accumulate significant amounts of coins via regular mining: Satoshi Nakamoto alone is believed to own over a million Bitcoin.